by

Daniel Burstein, Director of Editorial Content

In the

MarketingSherpa Ecommerce Benchmark Study survey, we asked:

Q. Please indicate the 2013 level of the following metrics and their ongoing trend. One of the metrics we asked about was gross margin percentage.

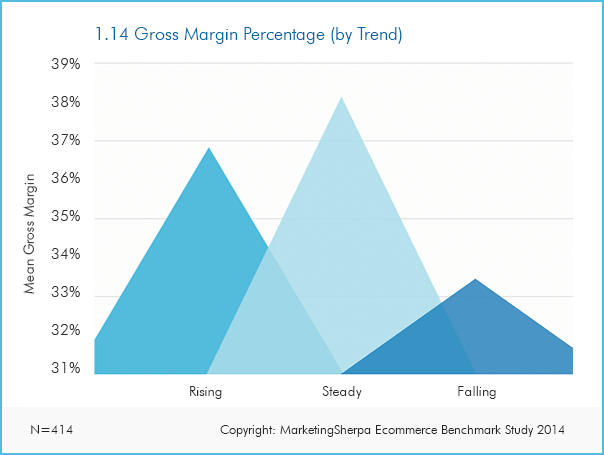

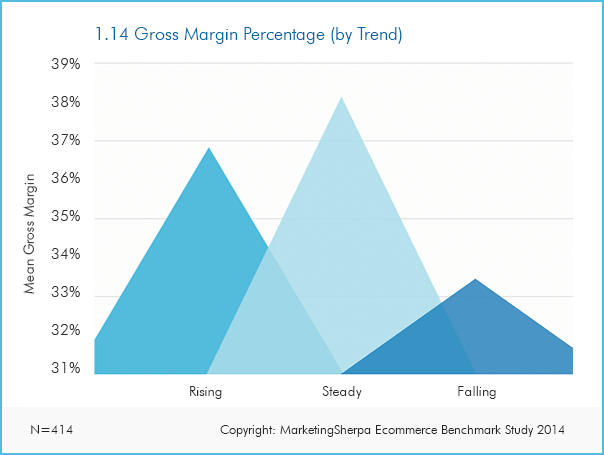

We also asked if the gross margin percentage was "Rising," "Steady" or "Falling."

Click here to see a printable version of this chart

From

a previous chart in the Benchmark Study, we learned that "Margins, or "Profitability," was the fourth biggest ecommerce challenge (after "Size of Marketing Budget," "Technology" and "Generating Additional Demand").

Margins are holding steady for most ecommerce companies

Despite the fact that so many marketers stated this challenge, data from the study shows that margins were only falling for 15% of companies.

However, margins were rising for only 25% of companies, so the 60% of companies that reported that margins were only holding steady might not be satisfied (especially since this number likely came off of a few tough, recession-addled years).

Companies with steady margins actually reported a slightly higher mean gross margin — 38% — than companies with rising margins (37%).

This may be because companies with rising margins had lower margins to begin with, which motivated them to take steps (whether decreasing cost or increasing value to justify higher prices) to increase margins.

After all, if price and cost changes are successful, the next step from being a company with a falling margin (companies with falling margins reported a mean gross margin of 33%) is to be a company with a rising margin, not a steady margin.

Margin trends varied across industries

For example, 57% of ecommerce companies that sell digital goods reported rising margins, with zero reporting falling margins. Digital goods sellers have been helped by both the extremely small (and often decreasing) incremental cost of new product delivery and the improving adoption and customer perception of value for items such as software, apps, game upgrades, digital music and digital movies.

However, companies selling automotive or motor parts and accessories faced the biggest challenge, with 26% reporting falling margins.

Optimizing margins in 2015

There is not a single right answer for how to manage margins in the year ahead, a proposition that will increasingly become trickier as consumer access to comparative pricing information — both in brick-and-mortar locations and online — gets easier.

This trend is good for consumers, and it can be good — albeit difficult — for companies as well since it is also breaking down even more barriers to reach customers. To succeed, you must understand your business model and consistently support it during every interaction with customers.

Is your company the low-price leader?

For example, if you are the low-price leader, price monitoring, matching and squeezing every penny out of the fulfillment process from wholesalers and vendors to final package arrival is crucial. Equally vital is making sure your prices are displayed anywhere your customers are looking for them.

"Being aggressive on price and sacrificing is not that bad if volumes compensate for it," said Rocco Baldassarre, International Business and Marketing Specialist, Zebra Advertisement.

One way companies have been trying to control costs and keep prices low is by better integrating brick-and-mortar locations and online channels — ultimately moving to a unified inventory and using brick-and-mortar stores to help with fulfillment.

For example, one Benchmark Study survey respondent talked about her biggest challenges by saying, "Further issues are low-price, low-quality competitors requiring us to reduce margins to stay competitive online as well as customers expecting free delivery. We are hoping channel integration will save us cost of labour to compensate for reduced profit margin."

Low prices can also be used as part of an acquisition or growth strategy. However, keep in mind that low prices are sticky. That is, once a customer has a set price in mind for your product or service, even if it is "introductory," it is very hard to change their perception that they should pay more for future products.

Or are you a premium brand?

Lowering prices even further isn't the only way to compete with low prices. If your business model is to be a premium or semi-premium product or merchant in your space, that can be a successful approach as well. This entails understanding what the prevailing low price is, determining what greater margin you expect for the increased value you provide and then clearly communicating why your product costs more.

"Most of my consumer product clients hold steady to a profitable margin because price is linked to quality in the consumer’s mind," Erin Bailey, Creative Director, Liftoff Marketing, said.

You can express that value proposition through content marketing while using landing page optimization and A/B testing to continually improve the messaging on your landing pages, for example. Then make sure that you really are showing the quality payoff for the higher price by securing customer reviews that back up your value proposition.

Sources

Zebra AdvertisementLiftoff MarketingRelated Resources

Subscribe to MarketingSherpa Chart of the Week — Learn from your peers and experts

Ecommerce Research Chart: Barriers to growthMarketing Research Chart: When to ask for customer reviewsOnline Course: Value Proposition Development (from MECLABS Institute, MarketingSherpa’s parent company)

For Amazon, the right price isn’t always the lowest price (by Don Davis in

Internet Retailer)

Amazon Bought This Man's Company. Now He's Coming for Them (by Brad Stone in

Bloomberg Businessweek)

Ecommerce Research Chart: Average gross margins for small, medium and large companiesMarketingSherpa Ecommerce Benchmark Study — Made possible by a research grant from Magento, an eBay company